PropNex Picks

|September 03,2025HDB resale prices weakened as sales volume retreated in August 2025

Share this article:

The HDB resale flat market took a breather in August 2025 as sales volume retreated and the average resale price moderated from the previous month. The decline may be partly due to the ample supply of new flats being launched by the HDB under its Build-to-Order (BTO) and Sale of Balance Flats (SBF) exercises, which saw more than 10,000 flats being collectively offered in July 2025.

Among the new flats launched towards end-July, more than 2,100 BTO units will have a waiting time of 3 years or shorter, while over 1,700 SBF flats are already completed. These flats may potentially have drawn some would-be buyers from the resale market, given that the completed SBF units are move-in ready, while the shorter waiting time for some BTO projects is seen to be acceptable to some applicants.

Additionally, many BTO projects are also in attractive locations near to an MRT station, further increasing the appeal of the new flats - particularly as they are more affordably priced than comparable resale flats in the same area. Furthermore, it is also possible that some prospective buyers are waiting on the October 2025 BTO exercise which will see some 9,100 new flats being launched in eight towns, including popular ones such as Ang Mo Kion, Bishan, Bukit Merah, and Toa Payoh.

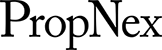

Based on transaction data, the HDB resale volume fell by 13.9% to 2,208 units in August from July, while the average resale price dipped by 0.9% month-on-month to $650,415 in August. When compared with August 2024, the transaction volume fell by 14.8% year-on-year, while the average resale price rose by 4.7% YOY (see Chart 1). The most popular towns which led sales in August were Sengkang, Yishun, Tampines, and Jurong West.

Chart 1: HDB resale volume and average resale price

With the HDB keeping up a steady pipeline of new BTO flats, the effects of prevailing cooling measures (e.g. tighter LTV limit for HDB home loans), and price resistance among buyers, the magnitude of gains in HDB resale prices are expected to moderate.

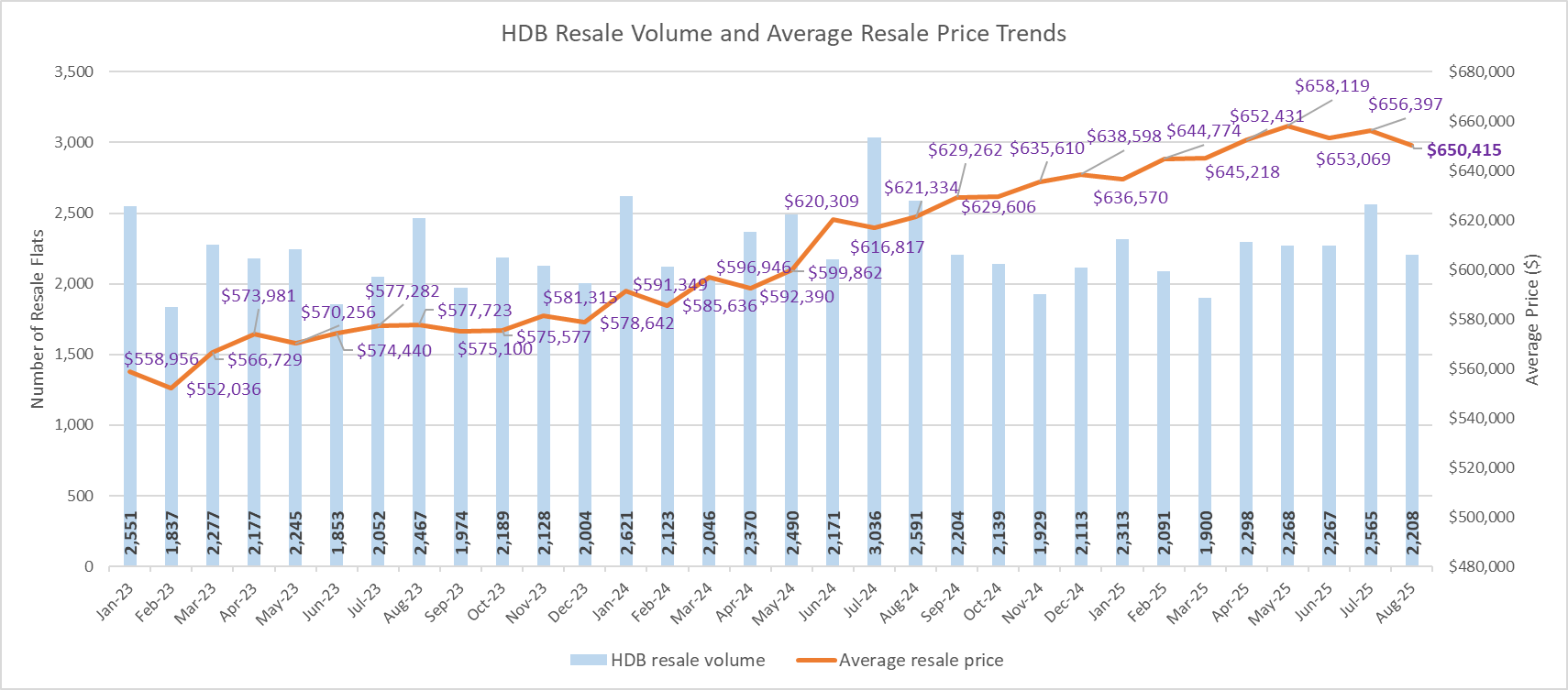

According to the sales data, about 23.6% of the resale flats sold were priced at below $500,000 in August 2025, compared with 21.2% in the previous month. Meanwhile, about 43.1% of the transactions fetched between $500,000 and $700,000 each in August - lower than 44.0% in July. The proportion of flats resold at $700,000 to just under $1 million was 26.9% in August, down from 28.3% a month before. The proportion of million-dollar resale flats sold also dipped, coming in at 6.4% in August compared with 6.5% in July (see Chart 2).

Chart 2: HDB resale flat transactions by price range

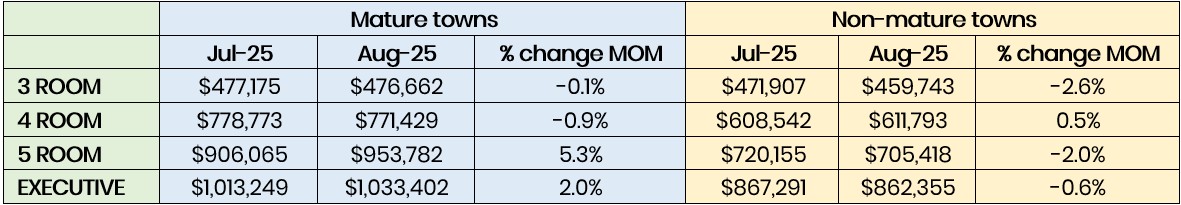

By flat type and town classification, larger flats in mature estates posted the steepest MOM price growth; the average resale price of 5-room and executive flats in mature towns climbed by 5.3% MOM and 2.0% MOM, respectively (see Table 1). Meanwhile, various flat types in non-mature estates saw MOM declines in average resale price, with the sharpest fall of 2.6% for 3-room resale flats.

Table 1: Average HDB resale flat prices by flat type, by town classification

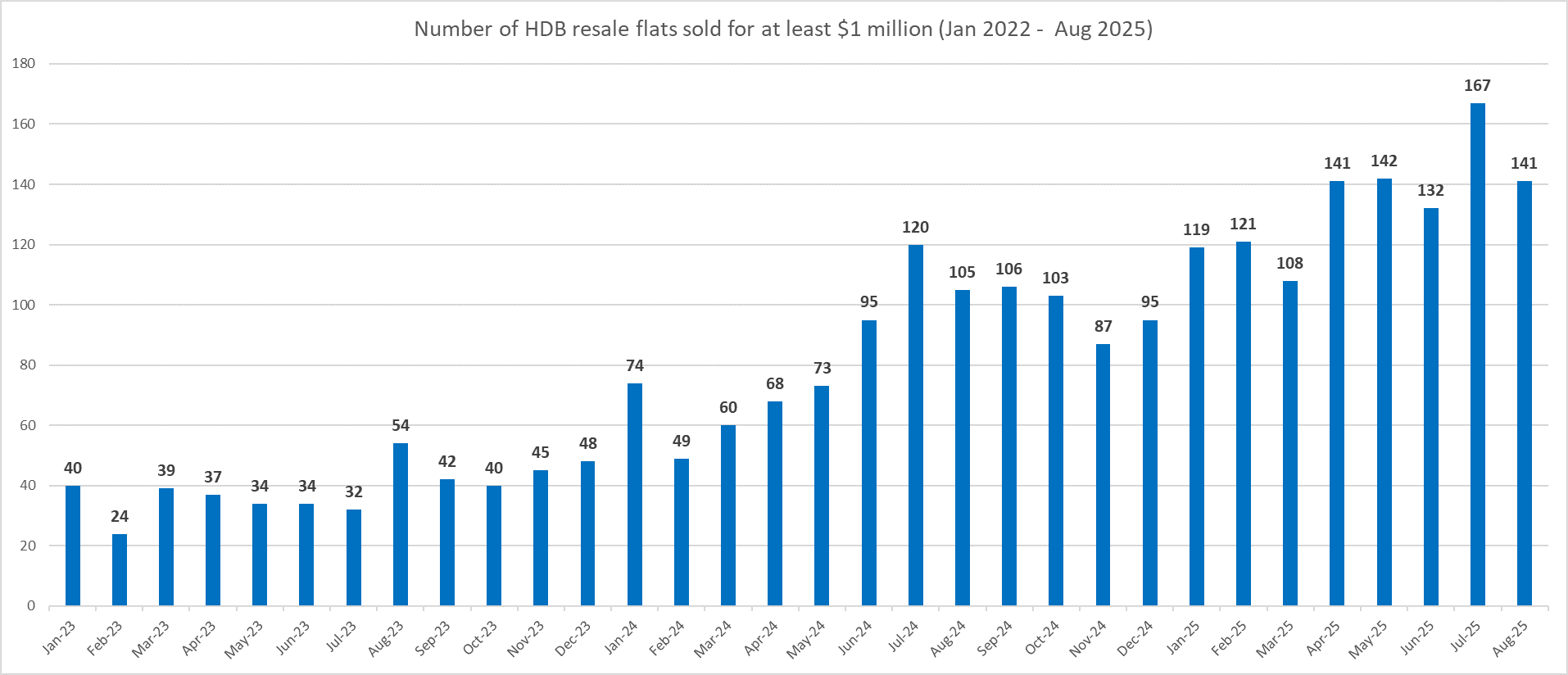

In August 2025, the number of HDB resale flats transacted for at least $1 million remains relatively elevated with 141 such flats changing hands. However, it is 15.6% lower than the record monthly high of 167 units of million-dollar flats resold in July 2025 (see Chart 3). This takes the total number of such flats sold in the first eight months of the year to 1,071 units, already besting the all-time high of 1,035 units of million-dollar flats transacted in the whole of 2024.

Chart 3: Number of HDB flats resold for at least $1 million by month

The 141 units of million-dollar resale flats transacted in August were made up of 62 units of 5-room flats, 55 units of 4-room flats, 23 executive flats, and a 3-room unit (Terrace flat). Of the total, 129 units are found in mature towns while 12 transactions are for flats in non-mature estates (Bukit Batok, Bukit Panjang, Hougang, Jurong East, Seng Kang, and Yishun).

In August, the towns with the highest number of million-dollar resale flat deals were Bukit Merah with 25 transactions, Toa Payoh with 22 transactions, Clementi with 15, Kallang Whampoa and Bishan with 13 and 11 such sales, respectively.

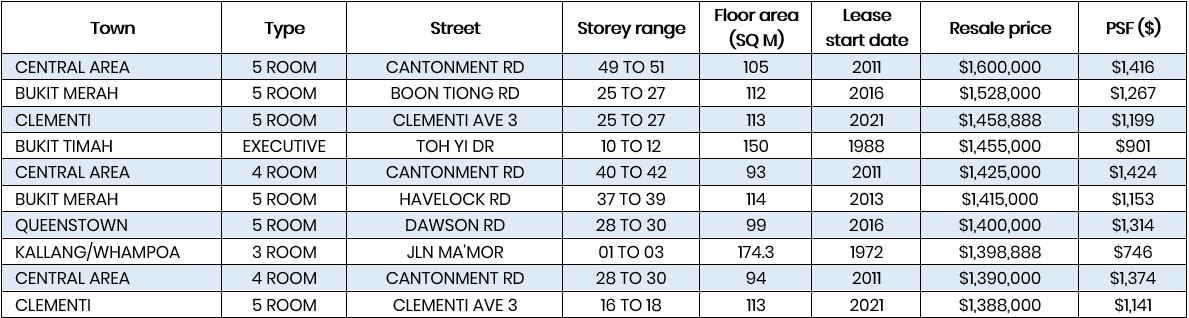

Meanwhile, the priciest flat resold in August was a 5-room unit in at Pinnacle@Duxton in Cantonment Road in the Central Area. Located on a floor ranging between the 49th and 51st storey, the 105-sq m flat with a remaining lease of around 84 years and 5 month at the time of sale had fetched $1.6 million (see Table 2).

Table 2: Top 10 HDB resale flats sold in August 2025 by Transacted Price

Contact a PropNex salesperson to find out more about resale HDB market trends.