PropNex Picks

|May 30,2025Two Condos, One Street - But Why Very Different Results?

Share this article:

Ever looked at two condominiums right next to each other and thought, "Wah, same area, both look nice - how to choose?" To most of us, it's not about which one will grow faster in price or become more popular. It's about which one feels like a better fit - better view, nicer pool, more convenient layout, or just the right vibe. But here's the interesting part: even when two condos seem almost identical on the surface, the way they perform and attract buyers over time can be totally different.

And if you're still weighing up between leasehold and freehold properties, check out our article: Breaking the New Launch Conflict: Leasehold or Freehold?

When two developments sit side by side, it's easy to assume they'll perform similarly in the market. After all, they seem to share the same broad strokes: a similar general location and comparable unit types. But don't be fooled by surface-level similarities. Whether it's a cluster of condos in East Coast, Novena, or Geylang, these neighbouring projects can turn out to be worlds apart in actual performance.

That's because it's not just about proximity or how the showflat looks - it's the subtle, often overlooked differences that shape a project's long-term appeal and investment potential. From the developer's track record and design quality to surrounding infrastructure and even the mix of residents, these quiet details often separate the winners from the rest.

When two condos seem similar on paper, it's the smaller, often overlooked details that make all the difference - especially when it comes to long-term value and everyday liveability. Whether you're looking at a shiny new launch or a resale unit with a few years of history, here's what truly sets one project apart from another:

1. Developer branding & execution

A reputable developer brings trust, better quality finishes, and attention to detail. Buyers are willing to pay a premium for a project by a developer with a proven track record. A well-known name often signals reliability and quality that lasts well beyond TOP.

2. Architectural design & layout efficiency

Iconic or standout designs can help a project stand the test of time - but they can also be a double-edged sword. While unique architecture may boost visual appeal, unconventional layouts or design elements like awkwardly placed pillars (think: Reflections at Keppel Bay) can compromise everyday practicality and usable space.

On the flip side, efficient and well-thought-out floor plans tend to enhance liveability, drive buyer satisfaction, and contribute to stronger resale demand. Ultimately, homes that strike a balance between aesthetic style and functional design are the ones that consistently attract interest and hold their value.

3. Facilities & lifestyle quality

Not all facilities are made equal. Some condos offer resort-style landscaping, well-placed pools, and functional communal spaces that feel like an escape - not just add-ons. And today, it's not just about gyms and BBQ pits - features like pet-friendly zones, dog pools, or dedicated pet runs are becoming lifestyle essentials. For instance, The Florence Residences in Hougang includes a pet's pavilion - a rare and thoughtful touch that resonates with animal lovers.

When the grounds are inviting and well-designed, it creates a sense of pride in ownership (and often, stronger buyer interest).

4. Micro-location nuances

Two condos can be in the same neighbourhood but feel worlds apart. Facing a main road vs a quiet park, being next to an MRT vs behind a petrol station - these micro-location differences can seriously affect desirability. Even small details like a side gate that offers shortcut access to a nearby MRT or mall can change how connected (or isolated) a development feels.

Always walk the ground and pay attention to what's just outside your future window - and how easily you can get to where you need to be.

5. What happens after TOP matters (Especially for resale)

If you're buying a resale condo, don't just look at the unit - look at how the entire development is being run. Is the landscaping well-kept? Are the facilities maintained? What are the monthly maintenance fees, and is there a healthy sinking fund in place for future repairs and upgrades? These are signs of strong post-TOP management, which can influence not just your living experience but also future value.

Also worth noting: the community vibe. Resale development with more owner-occupiers often feel more stable and welcoming, while those dominated by short-term tenants might feel more transient. It's one of those things you only notice one you move in - so it's worth checking out beforehand.

And if you're buying a new launch? It's still worth asking how the development will be managed after TOP. A beautiful project can lose its charm if upkeep slips - so it's good to think a few years ahead, even before collecting your keys.

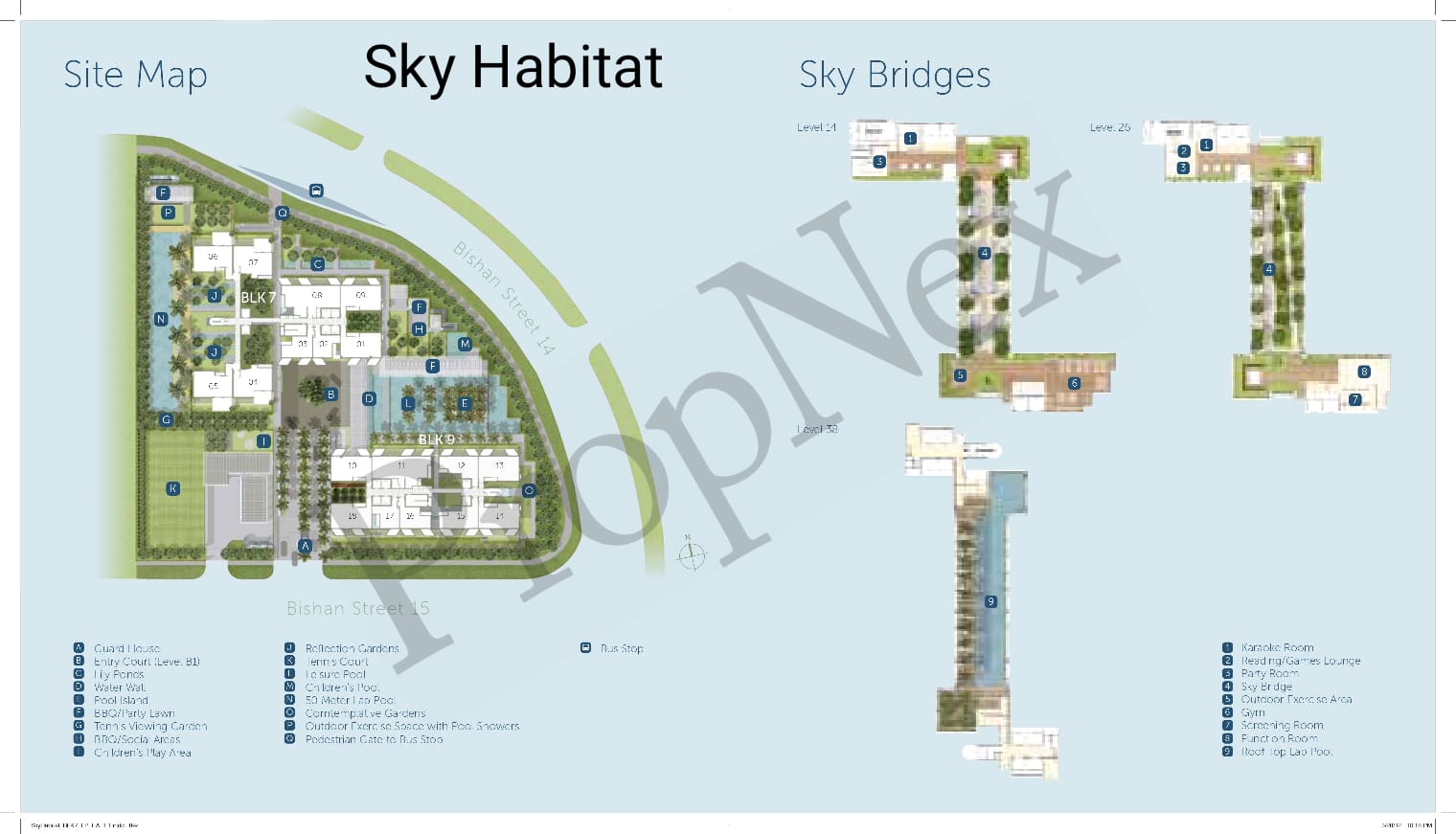

Feature | Sky Habitat | Sky Vue |

Developer | Capitaland & Mitsubishi Estate | Capitaland & Mitsubishi Estate |

Launch Date | April 2012 | September 2013 |

TOP Date | 2015 | 2016 |

Tenure | 99 years | 99 years |

No. of Units | 509 | 694 |

No. of Blocks | 3 blocks | 2 blocks |

Storeys | Up to 38 storeys | Up to 37 storeys |

Unit Sizes | 1- to 4-bedroom (635 - 3,671 sqft)* | 1- to 3-bedroom (484 - 2,282 sqft)* |

Location | Bishan Street 15 | Bishan Street 15 (next door) |

*Sizes are approximate and vary by stack/unit

Both launched around the same period and are located next to each other in Bishan. Although Sky Vue and Sky Habitat are neighbouring 99-year leasehold condos in Bishan by CapitaLand, Sky Vue commands a higher average psf. According to Investment Suite, Sky Vue hit an all-time average of $1,728 psf, compared to Sky Habitat's average of $1,565 psf.

Key reasons for this disparity:

Resale trend of Sky Vue (Red) vs Sky Habitat (Blue)

Resale performance: As of the date of publication, Sky Vue has 233 profitable transactions and 1 unprofitable transactions, while Sky Habitat has 106 profitable transactions and 28 unprofitable transactions, indicating stronger demand confidence.

Relaunch factor: Sky Habitat was relaunched at lower prices after cooling measures in 2013, affecting resale prices for early buyers.

Rental trend of Sky Vue (Red) vs Sky Habitat (Blue)

Rental demand: Sky Vue outperforms with higher average rental rates ($4.83 psf vs $3.90 psf) and more rental transactions (2,106 vs 1,158), making it more attractive to investors on the surface.

But beyond the numbers, rentability also comes down to tenant preference - especially in a slower rental market like today. If both developments are asking for similar rents, tenants, in my opinion, are more likely to choose Sky Vue for its proximity to the MRT, compact layouts, and overall convenience. In a low-demand environment, these small differences can tip the scales - meaning it's not just about commanding a high rent, but being the unit tenants pick first.

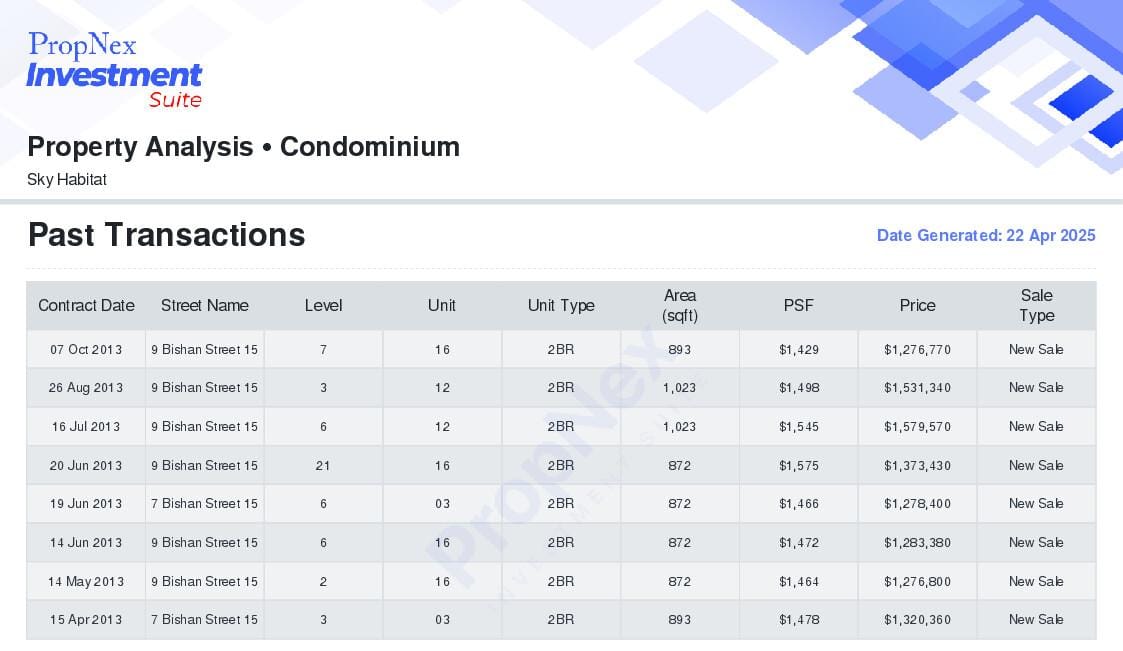

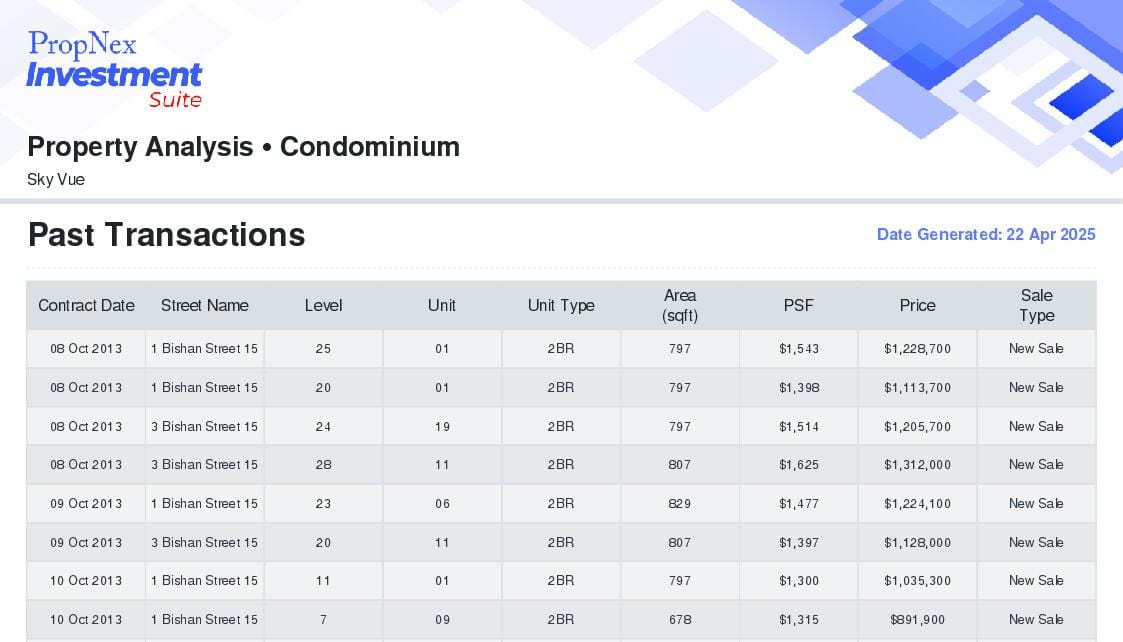

Pricing strategy: In 2012, the launch of Sky Habitat saw 60 2-bedroom units sold at an average of $1,593 psf. Just a year later, Sky Vue launched next door - and within months, it sold 275 2-bedroom units at a lower average of $1,413 psf. Even though Sky Habitat relaunch and adjusted its prices to remain competitive in 2013 (with some units going for as low as $1,429 - $1,575 psf), only 8 similar units changed hands that year - significantly lagging behind Sky Vue's explosive uptake.

For example, on 7 October 2013, a 2-bedroom unit (893 sqft) at Sky Habitat sold for $1,276,770, while just two days later, a slightly smaller 2-bedroom (829 sqft) at Sky Vue transacted at $1,224,100 - offering buyers a lower quantum in a newer, more compact project.

So how did two CapitaLand projects in the same location, with similar lease terms, produce such different results?

Design complexity and buyer hesitancy: Sky Habitat's iconic architecture - while visually striking - came with highly varied unit layouts. This design complexity made it harder for buyers to compare units and benchmark prices confidently. With so many different configurations, some buyers found it confusing or overwhelming, which led to hesitation and slowed transaction momentum, even though psf pricing was comparable to its neighbour.

First impressions: Sky Habitat entered the market with bold architectural ambition and even bolder pricing to match - with initial launch prices hitting as high as $1,700+ psf, which was steep for Bishan at the time. This premium set a psychological benchmark that many buyers struggled to justify, especially when more conventionally designed projects in the area were going for less.

Sky Vue, launched shortly after, capitalised on this perception gap. It entered the market with more accessible price points from the start, avoiding the need for mid-stream price corrections. This allowed Sky Vue to make a strong first impression, drive sales momentum quickly, and build buyer confidence early - a contrast to Sky Habitat's slower recovery after its initial pricing missteps.

Look beyond launch prices: Similar location doesn't guarantee similar performance. Two condos side by side or opposite one another can differ in pricing trends, rental demand, and long-term value - even if launched around similar time.

Understand unit mix and layout efficiency: The type of units offered and how well they're designed can influence a project's appeal. Compact efficient layouts may attract investors and tenants, while larger units may suit families or owner-occupiers.

Study the developer's track record: Past projects can offer clues about build quality, pricing strategy, and long-term performance. A developer with consistently strong launches and stable resale performance is worth noting.

Pay attention to buyer profile and community vibe: Who's buying into the development matters. A predominantly investor-heavy project might see more rental churn, while an owner-occupier mix could foster a more stable and engaged community - which can influence property value over time.

On the surface, neighbouring condos may look alike. But scratch beneath, and you'll see why one soars while the other lags behind. As with all investments, the small details - from architectural thoughtfulness to community management - make ALL THE difference.

If you're ever unsure, it's always wise to seek professional advice to help you make the most informed decision. At PropNex, our experienced real estate professionals are here to guide you through these details and help you make well-informed decisions that align with your goals. Our agents are also empowered with AI-enabled tools to ensure that you get the most up-to-date information and stats on the current market. This allows us to provide clear, data-driven insights so you can make confident and informed decisions.

Whether you're buying your first home or your next investment property, we're here to help - so you can move forward with clarity and confidence.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.