Press Release

|July 16,2025Developers' Sales Eased In June On Limited New Project Launches During The School Holidays; Primary Market To Get Lively In July And August

Share this article:

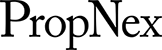

15 July 2025, Singapore - Developers' sales were tepid in June, as limited new launches during the school holiday period weighed on the transaction volume. There were 272 new private homes (ex. executive condominiums) sold in the month, marking a 12.8% decline from 312 units shifted in May 2025. This is also the slowest monthly sales in six months, since 203 new units were transacted in December 2024. On a year-on-year basis, sales were up by 19.3% from June 2024.

Only two fresh projects hit the market in June, being the 107-unit Arina East Residences which held a private placement exercise and the launch of the 105-unit Amber House. Both projects are located in District 15 in the Rest of Central Region (RCR) and have a freehold land tenure. In June, developers launched 187 new units (ex. EC) for sale - up significantly from the 20 units launched in May.

For the third straight month, the RCR led monthly new home sales. Developers sold 189 new units in the RCR in June, down slightly from the 191 units transacted in the previous month. RCR projects dominated the list of best sellers in June, including One Marina Gardens which moved 49 units at a median price of $2,962 psf, and Bloomsbury Residences which sold 30 units at a median price of $2,516 psf. Meanwhile, fresh projects that came onstream in June, Arina East Residences transacted nine units at a median price of $2,982 psf, and Amber House sold 17 units at a median price of $2,977 psf (see Table 2).

Developers shifted 69 new units (ex. EC) in the Outside Central Region (OCR) in June, representing a 34.9% fall from the 106 units sold in May. This is the lowest OCR monthly new home sales in over a year (16 months), since 58 units were sold in February 2024. Hillock Green was the top-seller in June, moving 12 units at a median price of $2,311 psf. Based on URA's data, the six new projects in Lentor Hills estate have collectively sold 2,845 out of the total 2,954 units available (or 96.3%) as at the end of June.

Over in the Core Central Region (CCR), there were 14 new units sold - the lowest monthly CCR new home sales since 13 units were sold in January 2009. The CCR projects that clocked the highest sales in June was Hill House, which sold three units at a median price of $3,249 psf. The four priciest homes sold in June are in the CCR: a 55th-floor unit at Skywaters Residences fetched $30.87 million ($5,841 psf); two units at 32 Gilstead were sold for $15 million each ($3,555 psf / $3,592 psf); and a unit on the 39th floor at Aurea that was transacted for $12 million ($3,691 psf). According to caveats lodged, the units at Skywaters Residences and 32 Gilstead were bought by Singapore PRs, while the unit at Aurea was purchased by a Singaporean buyer.

In the EC segment, developers sold 33 new units in June, rising by about 37.5% from the 24 units transacted in May. Aurelle of Tampines EC was the most popular project during the month, shifting 15 units at a median price of $1,813 psf. With the healthy demand for ECs and the steady paring down of unsold stock, there were only 18 units of new unsold ECs as at end-June, as per URA's data. This could pave the way for a strong reception at the upcoming EC launch, Otto Place in Plantation Close which will offer 600 new EC units.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"June was a relatively quiet month for developers' sales, but the lull is expected to be short-lived with sales projected to pick up in July as several new launches are lined up. Over the weekend, LyndenWoods, a new launch in Science Park in the RCR sold over 94% of its 343 units at an average price of $2,450 psf. Meanwhile, Otto Place EC, The Robertson Opus, and UpperHouse at Orchard Boulevard are slated for launch in the coming weekend (19/20 July). Taken together, the four new projects in July can yield 600 new EC units and nearly 1,000 new private homes.

Following the strong performance at the launch of LyndenWoods, we expect that it could help to generate some buzz in the new home sales market over the next few weeks as more launches come up. Furthermore, the slower growth in private home prices as reflected in the URA property price index flash estimates, a more benign interest rate environment, as well as the improvement in Singapore's economy may also lift buying sentiment. Generally, we do not expect the recent revision to the seller's stamp duty (SSD) to impact sales significantly as most buyers today hold a mid- to long-term view on their property purchase.

Notably, we anticipate new home sales in the CCR to rebound in July with the upcoming launch of the 301-unit UpperHouse at Orchard Boulevard and the 348-unit The Robertson Opus. Apart from the two abovementioned projects, another CCR development W Residences Marina View - Singapore, part of a mixed-use development is also conducting its private preview in July. Since the hike in the additional buyer's stamp duty (ABSD) in April 2023, there were around 53 CCR new homes sold on average each month between May 2023 and June 2025, based on the URA monthly developers' sales data. Prior to that, the average number of new CCR homes sold in a month was 175 units for the period from January 2022 to April 2023 (after the tightening of the ABSD in December 2021).

By and large, demand for new private homes will continue to be driven by local buyers. Based on caveats lodged, foreigners (non-PR) accounted for 1.5% of the non-landed new private home sales (ex. EC) in June 2025 - the lowest proportion in three months. In absolute terms, four units - one each at Irwell Hill Residences, One Marina Gardens, Pinetree Hill, and Terra Hill - were purchased by foreigners (non-PR) during the month. Meanwhile, Singapore PRs and Singaporean buyers made up 13.4% and 85.1% of the sales, respectively in June.

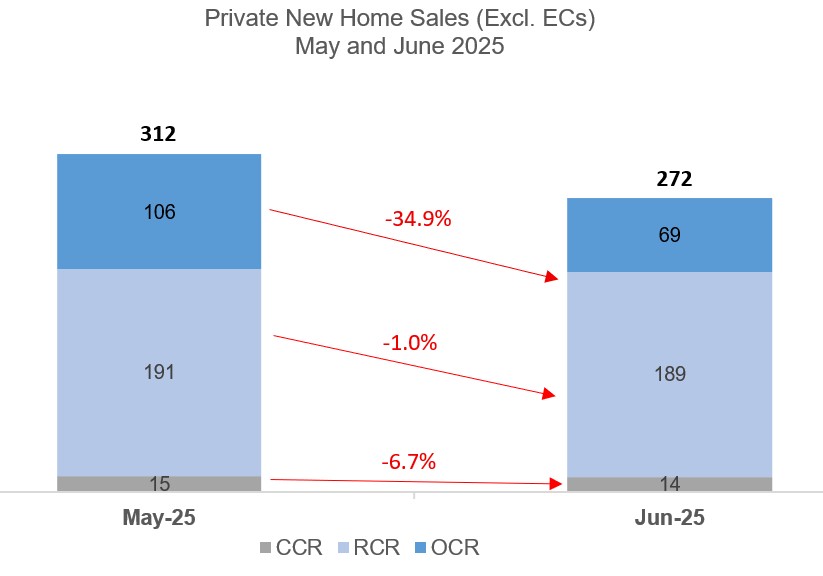

Table 1: Median unit price of non-landed new private homes sold (ex. EC) by region, by month, and price gap (%)

In June, the median transacted unit price of new non-landed private homes rose across the regions from May, with the RCR seeing a higher increase of 3.1% MOM to $2,732 psf, while the median $PSF price inched up by 0.5% MOM and 1.1% MOM in the CCR and OCR, respectively (see Table 1). We note that the price gap between the CCR and RCR has narrowed from 22.8% in May to 19.7% in June - among the tighter CCR-RCR price gap over the last few years.

June's sales take the overall developers' sales in Q2 2025 to 1,259 units (ex. EC). Overall, developers sold an estimated 4,634 new units (ex. EC) in 1H 2025 - on track to outperform the 6,469 units transacted in 2024. PropNex expects new home sales could come in at around 8,000 to 9,000 units (ex. EC) for the whole of 2025."

Table 2: Top-Selling Private Residential Projects (ex. EC) in June 2025